Trump's Economic Isolation and the Rise of BRICS

The chaos and lack of economic policy depth in the Trump Administration is forcing the world to recalibrate expectations and work around the United States.

By Max from UNFTR

WATCH THE VIDEO REPORT BASED ON THIS ARTICLE ABOVE…

President Trump currently has his sights set on BRICS member nations that gathered recently to discuss a coordinated global economic policy that circumvents the United States. As usual, President Trump took to Truth Social to offer an insane response.

The United States is playing a dangerous game right now, and the economic data are beginning to betray the Make America Great Again storyline.

The Brazil Smokescreen and BRICS Reality

Trump is using his defense of Jair Bolsonaro as a convenient smokescreen to pick a fight with Brazil, but the timing tells us everything we need to know about his real motivations.

Bolsonaro, for those who need a refresher, was Brazil's Trump-styled politician whom Trump personally admired and wants to see freed from charges by the Brazilian government. Bolsonaro is facing legal consequences for inciting an insurrection in Brazil that bears striking similarities to the January 6th riots here in the United States.

Birds of a feather.

But here's where it gets interesting. The timing of Trump's threat to slap a 50% tariff on Brazilian goods is markedly different from all those other boilerplate letters he's been sending to nations that haven't renegotiated trade deals with his administration. This isn't just another trade tantrum—this is strategic economic warfare disguised as trade policy.

And here's the kicker that exposes Trump's fundamental ignorance of basic economics: we actually have a trade surplus with Brazil. Let me repeat that for those in the back—the United States exports more to Brazil than we import from them. Putting tariffs on a country you have a trade surplus with makes zero sense.

So what's this really about? This is a calculated scheme to punish Brazil for serving as the current head of the BRICS alliance that recently convened to discuss moving forward with a more comprehensive cooperative economic agreement. And yes, they're seriously discussing the eventual rollout of a BRICS+ currency that could potentially be pegged to gold.

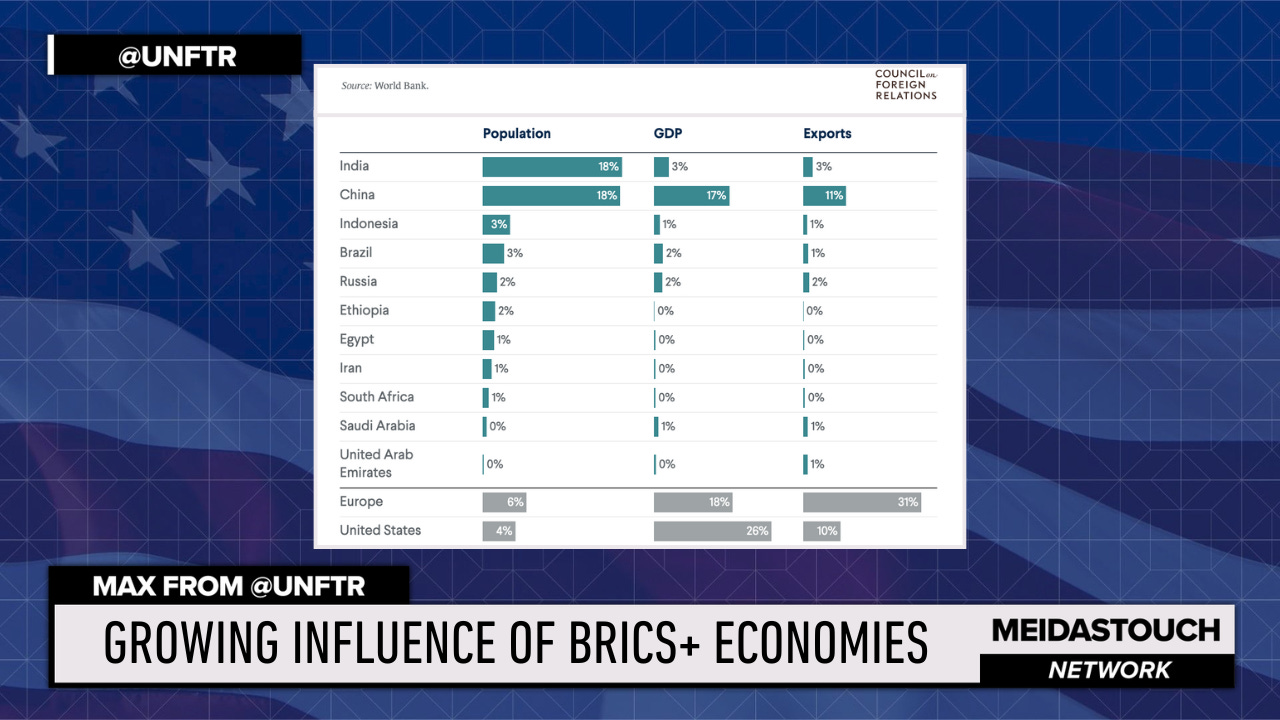

Take a look at this graphic showing the expanded BRICS+ membership. We're not just talking about the original Brazil, Russia, India, China, and South Africa anymore. The alliance now includes Egypt, Ethiopia, Iran, and the UAE, with Indonesia representing a particularly significant addition given its massive population and growing economy. These aren't small players we can simply ignore or bully into submission.

Now, let's be clear—a BRICS+ currency isn't viable in the immediate future. The technical and political hurdles are enormous, and even the recent summit in Brazil stopped short of announcing any concrete timeline. But here's what should terrify anyone paying attention to global economic trends: these economies are growing, their populations are expanding, and their discontent with unpredictable U.S. policies and Trump's on-again, off-again tariff threats is reaching a boiling point.

When you have countries representing nearly half the world's population actively discussing alternatives to the dollar-dominated system, dismissing their efforts as irrelevant is the kind of dangerous complacency that has historically preceded major shifts in global power structures.

The Dollar's Declining Dominance

Let's talk about something that should keep every American awake at night: the slow but steady erosion of the U.S. dollar's position as the world's dominant reserve currency. Now, before anyone panics, this isn't an immediate threat to our economic supremacy. The dollar will likely remain the world's primary reserve currency through 2035, but our dominance is beginning to wane in ways that have profound implications for our economic future.

First, let's understand why being the world's reserve currency is such a massive advantage. When other countries hold dollars in their central bank reserves, they're essentially lending us money at incredibly favorable terms. It means we can run larger deficits, maintain lower interest rates, and exercise extraordinary influence over global financial markets. It's been described as an "exorbitant privilege," and it's one of the primary sources of American economic power.

But here's what the data is telling us, and it's not encouraging. The share of U.S. dollar holdings in global allocated reserves has declined to 57.74 percent, and more concerning is the dramatic shift in sentiment among reserve managers. In just twelve months, the dollar has plummeted from being the most preferred currency among central banks to seventh place in preference rankings. That's not a gradual shift—that's a fundamental reassessment of the dollar's reliability and attractiveness.

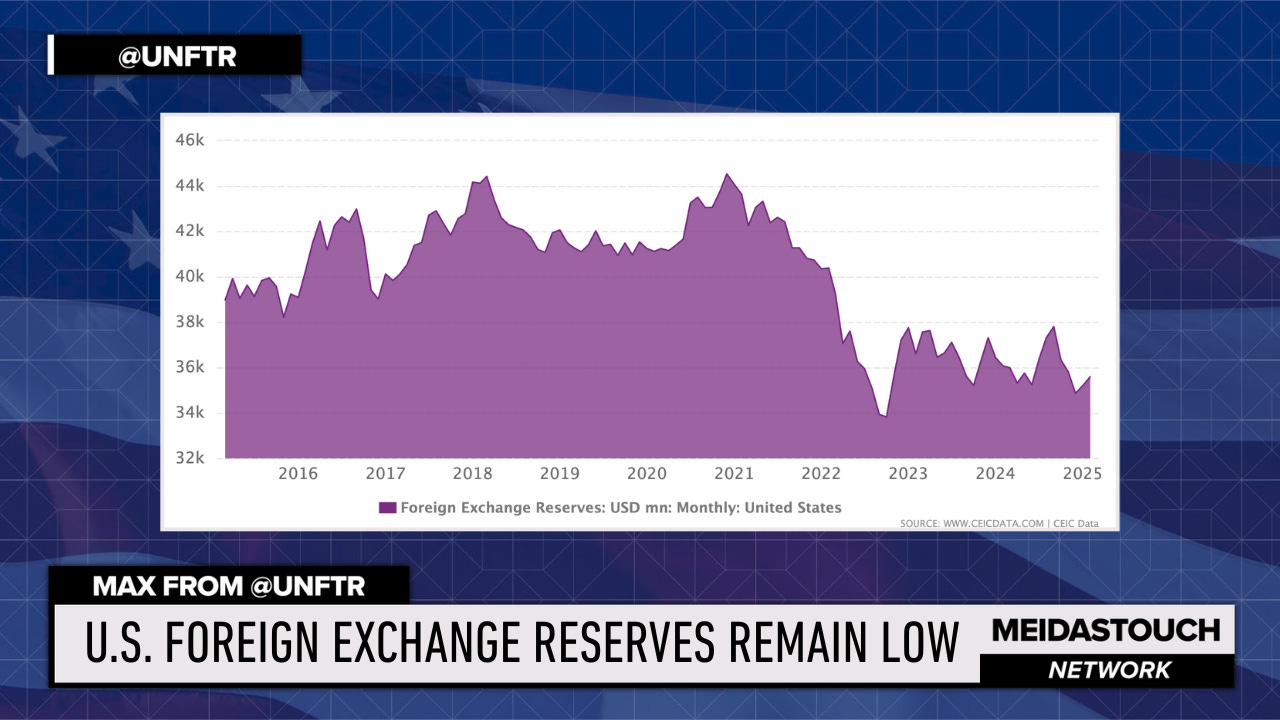

This graphic shows our foreign exchange reserves over time, and notice the significant decline that began in late 2022. Initially, this decline was driven by the Federal Reserve's aggressive interest rate hikes to combat inflation, which strengthened the dollar and forced other central banks to sell their dollar reserves to defend their own currencies. But here's what should concern us: even as the dollar has weakened recently, these reserves continue to decline.

Why? Because central banks around the world are actively and deliberately reducing their exposure to U.S. assets. This isn't just about currency fluctuations anymore—it's a structural shift in how global reserves are managed, with less emphasis on the U.S. dollar regardless of its exchange rate movements.

And this brings us to the fundamental contradictions in Trump's economic approach that are accelerating this global shift away from American assets. Trump is essentially trying to solve a Rubik's Cube while wearing a blindfold—every move he makes to fix one problem creates three new ones.

He wants to bring manufacturing back to America, which requires a weak dollar to make our exports competitive. But his tariffs strengthen the dollar by making foreign goods more expensive relative to domestic alternatives. He needs other nations to buy our goods, but he's alienating every single trading partner with unpredictable threats and constant trade wars.

Trump needs interest rates to stay high to curb inflation, but he also needs them lower to energize the housing market and reduce consumer debt burdens. He wants to keep prime-age labor participation high, but his administration is liquidating the federal workforce of exactly those prime-age workers.

Put simply, he can't have it both ways. Trump needs both a weak dollar and a strong dollar for his plan to succeed. He needs contradictory monetary policies. He needs cooperative trading partners while treating them as adversaries.

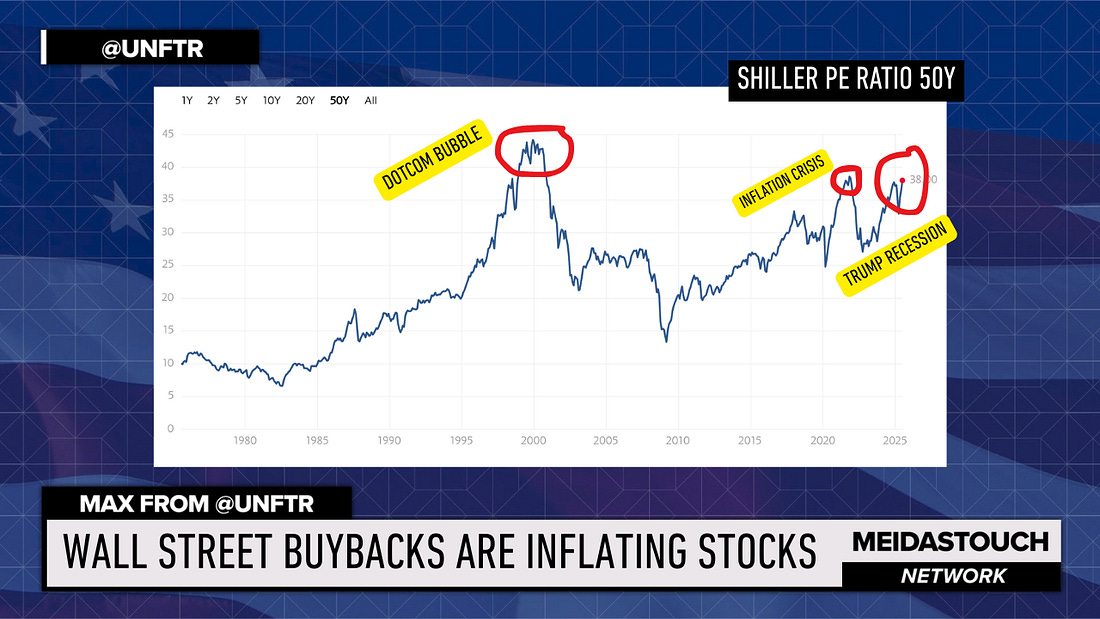

Most major banks and economists have already substantially lowered their growth projections for this year, and when you add up all these contradictory policies, here's what we can expect: low growth, rising unemployment, and rising inflation. In other words, the textbook definition of stagflation.

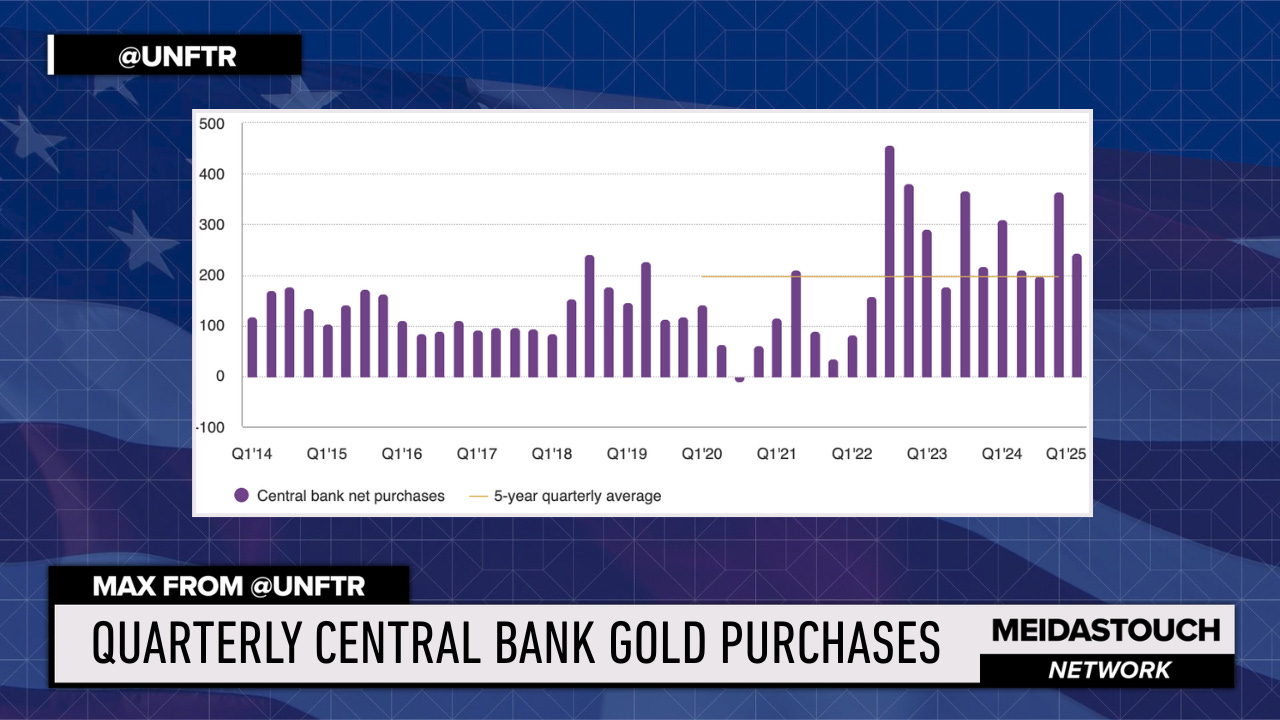

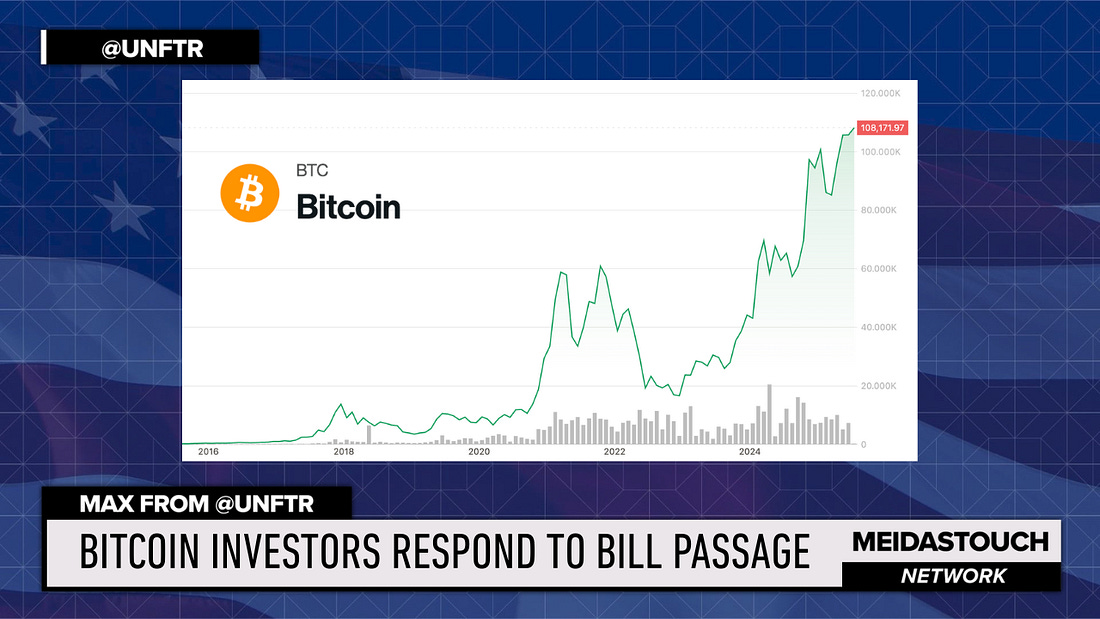

As a result, the world is responding by working around us rather than with us. The BRICS nations aren't just talking about alternative currencies—they're actively stockpiling gold as both a hedge against dollar volatility and as potential backing for future monetary arrangements.

This chart shows the dramatic increase in gold purchases by BRICS nations, with China and India leading the charge. They're not just buying gold as an investment—they're building the infrastructure for a monetary system that doesn't depend on American goodwill or predictability.

Degrading U.S. Economic Data

Inflation is moving higher again despite the Federal Reserve's aggressive rate-hiking campaign. The job market, which was supposed to be Trump's ace in the hole, is imploding. Initial jobless claims are spiking, job openings are declining, and hiring has slowed dramatically across multiple sectors.

GDP growth declined in the first quarter, and all indicators suggest we're likely seeing further contraction as consumer spending pulls back in response to higher prices and economic uncertainty. When you have both high inflation and high unemployment rising simultaneously, you've created the perfect conditions for stagflation—a crisis we haven't experienced since the 1970s.

Here's why this is particularly dangerous: in a normal recession, the Federal Reserve can lower interest rates to stimulate economic activity. In a normal inflationary period, they can raise rates to cool down the economy. But in stagflation, these traditional policy tools become useless or even counterproductive. Lower rates would fuel more inflation, but higher rates would crush an already weakening economy.

This means the Fed will inevitably need to resort to what's known as the "Fed Put"—essentially flooding the system with liquidity when critical segments of the economy start breaking down. But here's the problem: we need that liquidity to flow smoothly through the system, and we're already seeing signs that it's not.

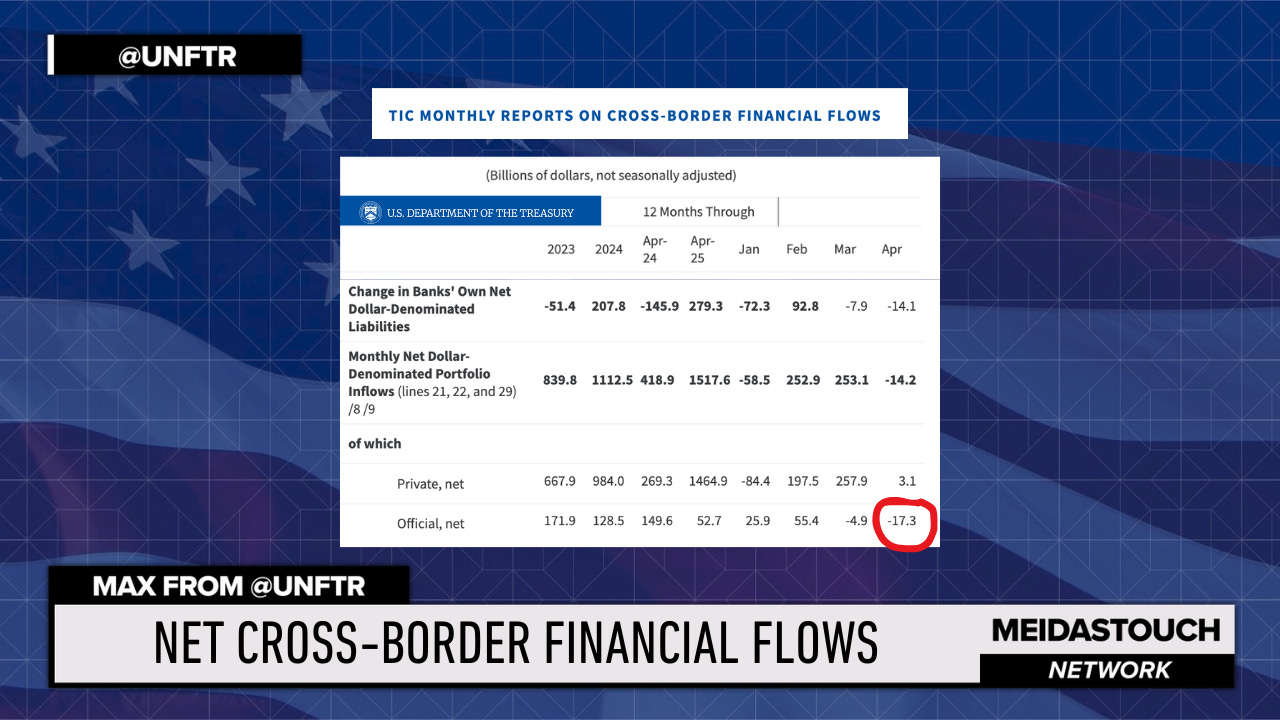

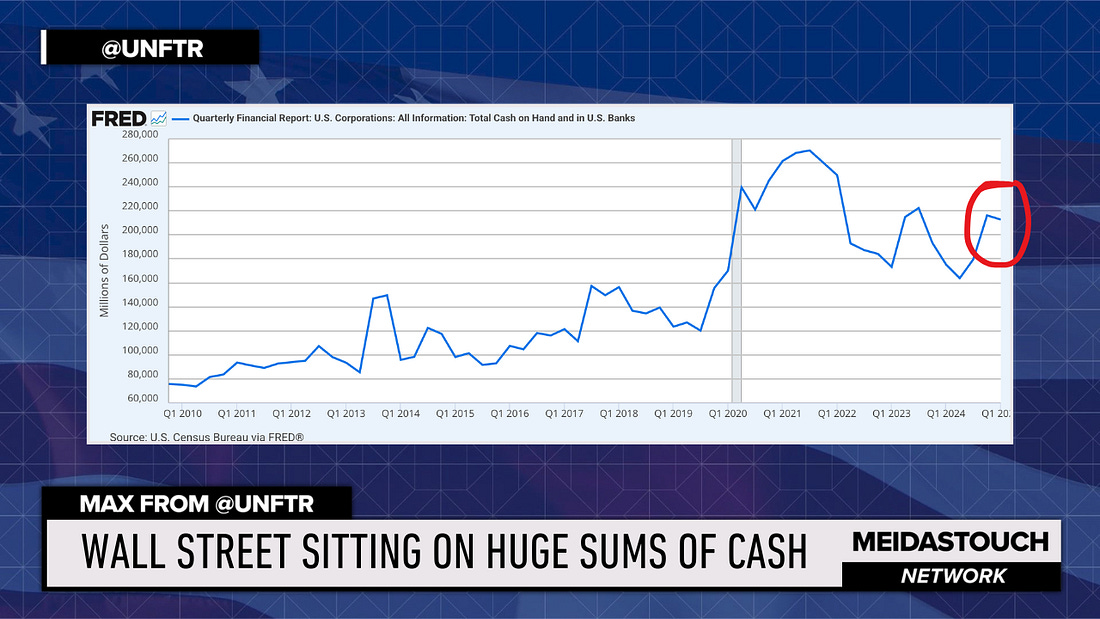

Take a look at the most recent Treasury International Capital data, which tracks money flows in and out of the United States. We're seeing net capital outflows, meaning more money is leaving the country than coming in. This is exactly the opposite of what you'd expect from the world's supposedly safest and most attractive market.

The next TIC report will be crucial in determining whether this is a temporary blip or the beginning of a more sustained trend of capital flight.

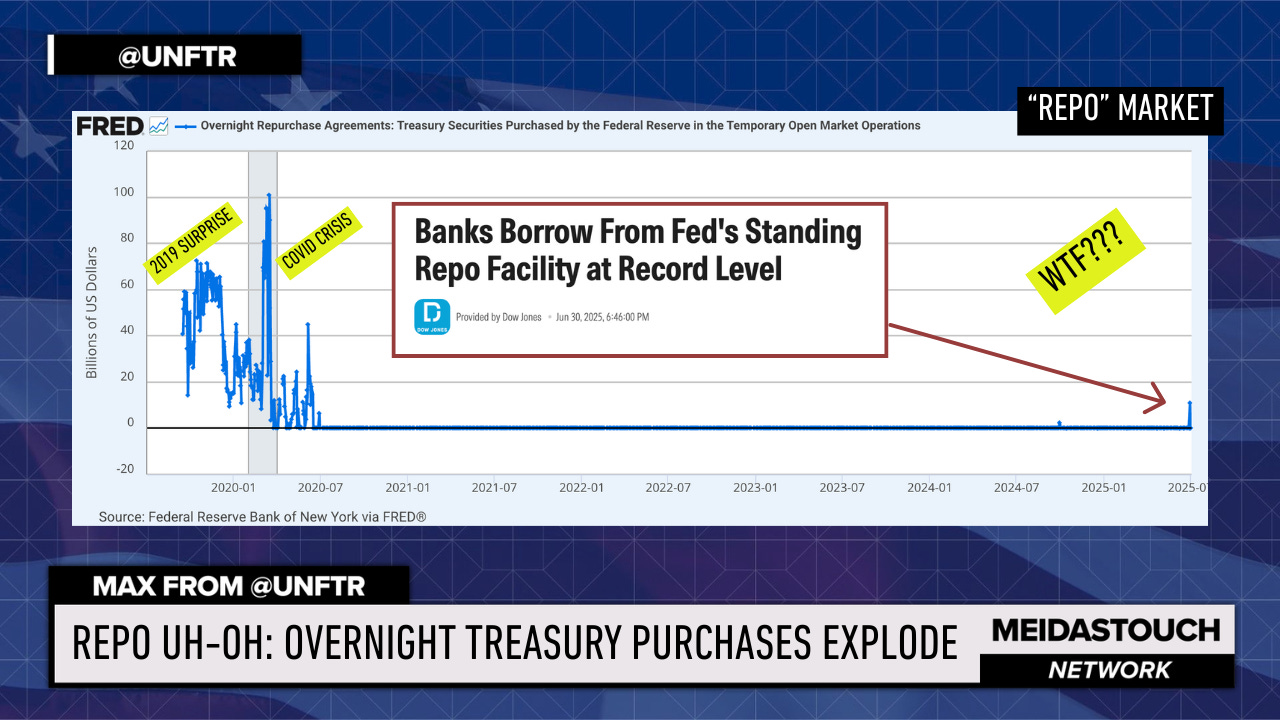

And here's perhaps the most concerning indicator of all: the Federal Reserve recently had to inject $11 billion into the overnight settlement market known as the REPO market. This intervention signals that there was a short-term cash crunch in the system and the Fed had to step in to ensure our financial institutions had enough liquidity to cover their daily trades and settlements.

REPO market interventions are often early warning signs of deeper stress in the financial system. When banks can't easily access short-term funding, it can quickly cascade into broader liquidity problems that threaten the stability of the entire financial infrastructure.

The Washington Consensus

But let's zoom out for a moment (by zooming in on our focus on Brazil) and examine how we got here, because Trump's current approach to Latin America and the Caribbean isn't happening in a vacuum—it's the latest chapter in a long and shameful history of American economic imperialism disguised as partnership.

Our relationship with the Latin American and Caribbean nations, known as the LAC region of the Global South, has always been that of the worst big brother imaginable. It's a story of either extreme interventionist paternalism or extreme indifference, with nothing resembling genuine partnership in between. We show up when it suits our business and political interests, and when it doesn't, we simply ignore them while never allowing them enough economic autonomy to pursue true independence or self-determination.

The historical record is damning. We overthrew the governments of Haiti, the Dominican Republic, Puerto Rico, Guatemala, El Salvador, Nicaragua, Panama, and even tiny Grenada. We offered them the hollow promise of protection in exchange for their resources and demanded they build infrastructure to serve our insatiable appetite for global trade dominance. We turned them into prisons, as with Guantanamo, cut-throughs for commerce like the Panama Canal, and resource extraction sites like Puerto Rico and Nicaragua. We used them as safe harbors for ill-gotten gains in places like the Caymans, Bahamas, and Virgin Islands. And when they dared to hint at self-determination, we invaded.

This pattern was codified in what became known as the Washington Consensus—economist John Williamson's 1989 framework that became the neoliberal blueprint for economic expansion, particularly targeting Latin America and the Caribbean. To be clear, Williamson offered this as an analysis rather than a prescription. The Washington Consensus demanded lower government borrowing, privatization of state-owned enterprises, elimination of trade restrictions, and the abolition of regulations that might protect local industries from foreign competition. It was economic colonialism with a sophisticated academic veneer.

And here's where Trump's current approach becomes particularly galling: we're still operating from this same playbook of economic bullying while expecting grateful compliance. We cozy up to authoritarian figures like El Salvador's Bukele and Brazil's Bolsonaro—leaders who suppress democratic institutions and concentrate power—while treating democratically elected leaders like Mexico's Claudia Sheinbaum and Brazil's current president Lula da Silva with suspicion and hostility.

The message this sends to the region is crystal clear: we prefer dictators who will do our bidding over democrats who might prioritize their own people's interests. It's exactly this kind of hypocritical, self-serving approach that's driving these nations toward alternative economic arrangements like BRICS+, where they're treated as partners rather than colonial subjects.

Playing Fast and Loose with Global Stability

What we're witnessing is a president who is playing fast and loose with the global economy while demonstrating a fundamental misunderstanding of how international markets actually function, how fragile these interconnected systems really are, and how willing the rest of the world is to move forward without American leadership.

Trump seems to believe that because we're the largest economy, everyone else will simply accept whatever terms we dictate, regardless of how erratic or self-defeating our policies become. But global markets don't operate on the basis of size alone—they require predictability, consistency, and mutual benefit.

The BRICS nations aren't plotting against America out of malice—they're responding rationally to an increasingly unreliable partner who threatens tariffs one day, demands loyalty the next, and changes policy direction based on social media whims rather than strategic thinking.

All of this is happening at precisely the moment when we're clearly heading into a stagflationary environment that will be disastrous for the American economy and, by extension, the global economy. Because when the United States catches a cold, the rest of the world gets the flu.

But here's the difference this time: instead of waiting for America to recover and lead the global response, other nations are building their own economic immune systems. They're creating payment networks that bypass the dollar, accumulating gold reserves that provide alternatives to dollar-denominated assets, and forming trade agreements that reduce their dependence on American markets.

The tragedy is that none of this was inevitable. American economic leadership could have been maintained through cooperation, consistency, and recognition that in an interconnected world, everyone benefits when trade relationships are stable and predictable.

Instead, we have an administration that views every economic relationship as a zero-sum competition to be won rather than a mutually beneficial arrangement to be nurtured. The result is that America is increasingly isolated from the very global economic networks that have been the foundation of our prosperity for decades.

The question now isn't whether other nations will continue building alternatives to American-dominated systems—they're already doing that. The question is whether we'll recognize the damage being done and change course before these alternatives become so robust that American influence becomes irrelevant.

Because in the game of global economics, if you're not growing together, you're growing apart. And right now, the world is growing apart from America at an accelerating pace.

Max is a contributor to the MeidasTouch Network and Publisher of UNFTR Media. Watch his video report on this topic by clicking here or by watching the video at the top of this article.